As the fintech industry continues to grow, establishing media credibility has become more crucial than ever. By incorporating effective fintech pr strategies, fintech businesses can not only enhance their brand awareness but also establish trust with their target audience and get third-party recommendations.

A robust public relations strategy goes beyond just product announcements to focus on education, transparency, and third-party validation to reassure clients and investors that their data and money are safe with you.

Getting the attention of your customers in the highly competitive fintech market is very difficult; however, this blog can help make it easier for you. It will discuss what fintech public relations is, why it matters for fintech businesses, effective public relations strategies for fintech companies, and more. So, let’s get started.

What is FinTech PR?

FinTech PR is a specialised communication strategy especially designed for financial technology companies in order to help them clearly convey what they do, why it matters, and why people should trust them.

It includes effectively managing the online reputation of a fintech company, fostering relationships with stakeholders, and successfully communicating its products, vision, and achievements to the general public.

What are the major components of effective PR for fintech companies?

- Media Relations

Fostering relationships with renowned media outlets and journalists who specializes in fintech is crucial.

This relationship can help fintech companies to showcase the brand new service that they have recently launched, face regulatory challenges that require instant public response, and secure funding rounds.

- Crisis Communication Planning

This is another crucial PR element for fintech companies, especially given the sensitive data and consumer trust that fintech companies need to deal with.

Crisis communication planning is an important component of fintech media relations that helps financial technology companies prepare themselves for crises such as data breaches, technical failures, and failed regulatory investigations that might negatively impact their reputation as well as user confidence.

- Investor Relations

This is another major element of fintech media relations that can help fintech businesses attract and retain capital by communicating their value proposition to prospective sponsors.

This component especially involves creating materials that clearly convey market opportunity, competitive edges, and growth potential while directly addressing concerns regarding rapid market shifts and regulatory risks.

- Stakeholder Engagement

Interacting with stakeholders such as customers, regulators, investors, and partners is another crucial aspect of PR for fintech companies. Establishing meaningful relationships with these groups can help foster credibility and trust.

- Thought Leadership

PR for fintech companies often include positioning major executives and experts as thought leaders within the fintech industry. This is attained by participating in or engaging in events, contributing to industry publications, and sharing valuable insights on changing trends of the fintech industry.

Why Does your FinTech Business Need PR

Now that you have a clear idea of what fintech PR is and the major components of fintech PR, let’s take a look at why fintech firms must invest in effective public relations.

- Successfully Navigating Complexity

The fintech market is highly complex. Furthermore, fintech firms are required to deal with complicated regulatory frameworks, financial technologies, and constantly emerging market dynamics. An effective fintech public relations strategy can help fintech companies simplify these complexities for a wider audience.

- Help Establish Trust

Trust is at the core of finance. Fintech companies must make sure to gain enough trust from their customers in order to position themselves in a prominent place in the fintech industry. Successful public relations efforts can prove to be instrumental in fostering trust by not only clearly showcasing the reliability and expertise of a fintech firm but also its commitment to security.

- Attracting More Investors

In a heavily competitive field like fintech, securing funding is very important for growth. Fintech media relations is crucial to gain the attention of investors by clearly showcasing the company’s achievements, capabilities, and future opportunities.

- Easily Navigating Regulations

There are a lot of regulations and compliance standards fintech companies must adhere to. A well-planned public relations strategy can allow fintech firms to easily navigate these regulatory standards by guaranteeing transparent communication and showcasing a strong commitment to compliance.

Best Fin-tech PR Strategies to Successfully Establish your Fintech Brand

An effective public relations strategy can help financial technology companies build thought leadership and set them apart from their competitors. So, here are a few tested-and-proven strategies that can help fintech businesses establish a positive reputation online.

Define your Goals Clearly

First things first, before you even start implementing public relations in your fintech business, you need to set defined goals for your brand’s development and then determine which of them you wish to achieve with your fintech pr efforts. In the rapidly emerging fintech industry, setting up defined and measurable goals is crucial to ensure success.

Establishing brand awareness is a great start; however, you need to break it down into more comprehensible and easy-to-read chunks. Some common PR strategy goals that fintech companies must consider can be:

- Positioning your fintech company as a thought leader in the industry

- Clearly conveying how your products or services outperform your leading competitors. Make sure to always keep them in mind as they are crucial assets to ensure success.

- How can you increase the brand awareness and visibility of your fintech firm?

- Successfully managing reputation and handling crises dynamically.

Determine your Target Audience

The next step is determining your target audience. When you have a well-defined objective, you need to know what your audience wants. Your products or services must be able to clearly address and resolve their problems, so fintech companies must make sure they are familiar with their needs and common concerns.

This starts with a thorough competitive analysis to determine what your competitor is currently onto, identifying any gaps in the market, and incorporating the opportunities that are found to set your unique products and services apart. Once you are done narrowing down your niche and the audiences you are targeting, tracking trends of the fintech market naturally becomes the next step.

Closely Monitor Industry Trends

Keeping track of the latest trends in the fintech industry that are relevant to your niche is crucial to staying ahead of fierce competition.

Not only that, but it also ensures that your strategy perfectly corresponds to the market expectations, allowing you to modify your offerings with the evolving needs of the customers.

For example, if you are a B2B fintech company offering a fixed finance solution, then you should pay close attention to the growing demand for real-time payments, especially within the supply chain or e-commerce sectors.

Creating marketing-related content that sheds light on faster b2B transactions can showcase how your business is adapting to the emerging trends, positioning you as a forward-thinking business in the fintech sector.

Align your PR Efforts with your Digital Marketing Strategy

Before you dive into PR, you must make sure that your fintech company is well-prepared and has an overall marketing strategy. In order to ensure this, you can partner with a professional PR agency, as they can help align your PR strategies effectively.

In contrast to pay-per-click advertising, where you can simply launch, test, and monitor your campaigns, it takes months or even years to build strong relationships with the media.

So, fintech companies must make sure to have a clear understanding of their target audience, business objectives, and the latest trends in the fintech market.

It is very important to prepare content materials beforehand. Develop a solid fintech content marketing strategy, a proper media kit with engaging designs, videos, and photos of your products or services, as well as a press release.

Nowadays, simply having a press release is not enough. Fintech companies must make sure that they have a complete document with detailed information on the products, services, companies, and all relevant contacts that can help them pitch to the media.

Identify Audiences within the Media

Successful fintech PR means determining the reporters and news publications that are relevant to your products, services, and business. In order to identify audiences within the media, fintech firms can partner with writers who have written fintech-related content for media outlets in the past.

Here are a few steps fintech companies can take to make reporters aware of their business and encourage them to engage with it.

- Build Meaningful Relationships with Relevant Journalists: Fintech companies must identify reporters who cover stories on financial technology, banking, cryptocurrency, and other relevant industry topics. This is crucial for effective crypto pr. Make sure to engage with their work on various social media platforms and share valuable comments even before you start pitching a story. This will help establish a foundation of recognition and trust.

- Offer Valuable and Data-Driven Insights: Make sure to offer reporters exclusive data, research, or market analysis that can help them create engaging and news-worthy stories. Generic company updates have a lower chance of getting picked up than unique insights into market trends.

- Make Use of Customer Success Stories: Provide reporters with clear and measurable case studies and engaging narratives from happy clients that showcase the real-world impact and effectiveness of the fintech solutions.

- Predict and Directly Address Industry Pain Points: Fintech firms can position their company’s solution as an answer to current challenges in the fintech sector. This makes their story relevant to the contemporary news cycles and in fintech-related discussions.

- Employ Clear and Accessible Spokespersons: Fintech companies must make sure they employ media-trained executives who are readily available to offer quick, valuable quotes or interviews. This is because timeliness is very important for reporters who work under tight deadlines.

- Leverage a Targeted and Personalised Pitch Strategy: Rather than sending mass emails, personalise each pitch to the specific reporter’s interests and recent articles. Make sure to clearly explain why your audience would be interested in your story.

Choose the Right Distribution Channel

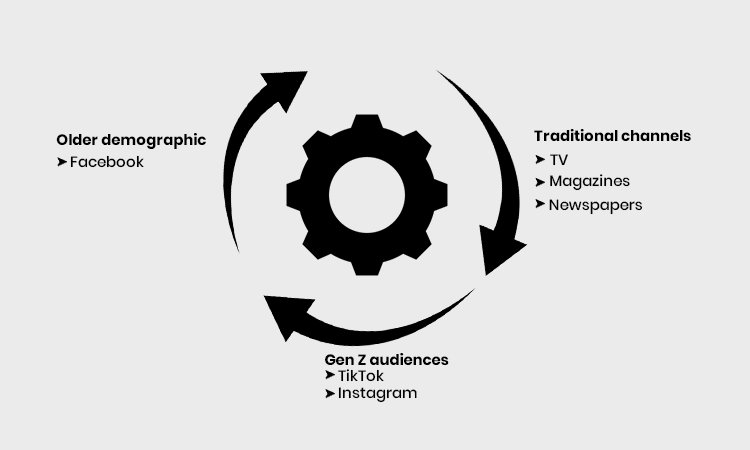

When you know who your target audiences are, you must now figure out which media channels you want to target. The financial services industry has transformed the way these channels are leveraged and used. The fintech industry is huge, and various sectors need various media strategies.

Certain fintech businesses might benefit from traditional channels like TV, magazines, and newspapers, while others might witness better results through digital channels such as YouTube and social media.

If your fintech products or services target Gen Z audiences, then emphasise platforms like TikTok and Instagram to engage with your audience through short and educational content such as reels and videos. On the other hand, if your fintech products target a slightly older demographic, then you can use a platform like Facebook to create and share videos or images that are resourceful for the older demographic.

Once you are done choosing the right distribution channel for your fintech business, you must make sure to track key metrics such as engagement rate, completion rate, and shares without fail in order to monitor and measure the effectiveness of your campaign.

Collaborate with Finance Influencers and Journalists

Done figuring out the right distribution channel for your fintech business? Now, in order to maximise the impact of your business, you must pitch the right influencers or journalists. For example, targeting journalists or influencers who can cover topics like asset management can be very effective for fintech companies.

Before you start pitching, make sure that this is the best way for a journalist or an influencer to explore your fintech business. However, fintech companies must avoid getting intrusive, which means if they have not “traded” their news and continue writing to a journalist, then they are highly likely to get banned.

Due to busy schedules and high volumes of requests to cover stories, a lot of influencers and journalists do not respond to emails or convey their desire to cover your business story. Rather than taking this as a personal insult and not reverting back again, fintech firms must keep track of whether or not they have opened and read your message.

Modern tools can allow fintech companies to determine when and where the letter was opened, from which device, whether any attachments were downloaded, or whether any links in the letter were clicked or not.

After you are done assessing the behaviour of the journalist or influencer, you can now write the follow-up, determining exactly what actions the journalist is taking with the letter you have sent and exactly which part of it was found interesting by the journalist or influencer.

Create Engaging and Valuable Content for Messaging

The fintech sector might often feel highly complex and terrifying to customers, especially for those who are not familiar with the technicalities of the financial industry. This is why educating your audience with clear and engaging content is crucial.

By breaking down the complexities of their products or services, fintech companies can make sure their audiences achieve a better understanding while gaining credibility. It would be even better if you could show how your products or services can solve real-life problems of your customers. By doing this, you could make it easier for your audiences to engage with your business.

In a heavily competitive fintech space, it is very important to clearly convey the unique selling propositions and benefits of your products or services in order to showcase their actual value. However, fintech companies must make sure to do all this while being completely transparent about how their products work.

Fintech businesses must personalise their messaging to specific segments of their target audience. Personalised messages can help foster trust within the audience, ultimately driving more engagement.

But now the question arises, how can a fintech business develop an effective content marketing strategy?

Fintech PR strategies must include a variety of content, such as thought leadership content, topical pitches, research reports, press releases, and more.

- Topical Pitches: Pitches are an excellent media relations tactic that includes dynamically reaching out to well-known journalists and media outlets in order to share a story or announcement regarding your fintech business that they may be interested in covering. PR pitches usually connect the story of your business to news, latest trends, or events of the fintech sector and can be a great way to offer company executives the opportunity to discuss trending fintech-related topics and breaking news.

- Press Releases: Press releases are content formats in public relations that usually involve summarising news related to your fintech company. For example, the launch of a new product or service, funding announcements, or more.

- Research Reports: Fintech companies often have to deal with a vast amount of confidential customer data that is available to them. These can offer valuable insights into the way that customers and businesses are thinking about and engaging with financial technology. These data can be put together into whitepapers or third-party research reports, which are a great way to authenticate your fintech company’s crucial messages by supporting them with relevant data.

- Thought Leadership: Though leadership articles are a great way to convey expert opinions and insights within a particular field or subject. If done correctly, thought leadership content can position your company’s executive as an authoritative or thought leader. The most common forms of thought leadership can include podcasts, blogs, or interviews.

- Awards and Speaking Engagements: Awards and speaking engagements can offer extra exposure for your fintech company’s crucial messages and offerings beyond traditional media sources. Effective fintech media relations strategies must include a lengthy list of speaking engagements or awards that are relevant to your fintech company in order to stay ahead of content submission deadlines.

Utilise Social Media

Social media is a crucial tool for effective public relations. Ideally, the financial sector has not been through the easiest time cracking the social media, especially the banking sector, which has taken quite a lot of time to adapt to these channels.

The understanding of financial businesses on social media has emerged since then, largely due to Fintech companies.

Fintech firms must make sure to be where their audiences are. This audience includes both the media they are trying to pitch and the target audience they are willing to attract. So, fintech businesses must make sure that public relations is at the top of their marketing strategy.

Fintech companies can leverage social media platforms to share updates, answer common customer queries, and conduct live Q&A sessions to effectively engage with customers.

How can a FinTech PR Firm Help Finance Companies to Establish Media Credibility?

There are several ways a fintech public relations firm can help financial technology companies build media credibility.

- Foster Trust and Credibility

In an industry that deals with a vast amount of sensitive financial data, fostering trust should be predominant. An experienced public relations firm can develop narratives that strictly focus on security, reliability, and transparency to assure investors and customers.

Third-party validation through media coverage is another effective way and is much more impactful than paid media in this case.

- Build Media Relations

A good fintech PR agency comes with hands-on expertise and can leverage its strong relationships and sources with expert tech and financial journalists in order to secure valuable and earned media coverage in renowned publications, enhancing the visibility and authority of your fintech business.

- Establish Thought Leadership

Experienced fintech pr teams can prominently position your company’s founders and executives as experts in the fintech industry through opinion pieces, engaging in major conferences, and writing guest articles. This can position your company as an authoritative source in the fintech sector.

- Effective Crisis Management

In case of accidental data breaches, regulatory issues, and product glitches, an experienced PR agency comes with a proven track record and can help fintech companies successfully deal with these situations dynamically. By developing effective communication plans, these specialized agencies can help eliminate reputational damage and preserve public trust.

- Simplifying Complicated Concepts

Fintech products often involve complex technologies like AI or blockchain. Expert blockchain PR companies can effortlessly translate these technical complexities into simple, more comprehensible messages that perfectly resonate with the mainstream audience, successfully encouraging customers to choose your products over others.

- Successfully Attracting Investors

Effective PR efforts can significantly improve the confidence of investors by showcasing growth milestones, funding rounds, and shaping market perception. All this can help fintech businesses to secure future investments.

- Creating Valuable Content

Experienced public relations agencies can help fintech businesses develop engaging content, such as whitepapers, blog posts, articles, and case studies, to educate audiences and offer visible proof on how effective and valuable their products or services are for potential audiences.

Challenges in Establishing Trust Through FinTech PR

Building trust through public relations for fintech companies includes navigating several challenges in a highly regulated industry. Here are some of the major challenges that fintech companies must watch out for.

- Building Trust in a Highly Regulated Industry

As discussed earlier, the financial technology sector is highly complex and strictly regulated. This requires fintech businesses to focus on transparency and compliance above everything else.

Fintech companies must make sure all their interactions strictly adhere to the guidelines of regulatory bodies. This consistent mistake can slow down the PR process and requires legal reviews for almost every public statement.

Developing public relations strategies that focus on conveying solid data security measures and regulatory compliance can help establish confidence among prospective customers.

- Communicating Complex Financial Concepts

Fintech innovations often involve complicated technologies (e.g., AI, blockchain, complex algorithms) and financial complexities that might confuse average customers.

The challenge here is to translate these complicated ideas into clear and easily comprehensible language without oversimplifying the concept or losing crucial details.

Fintech businesses can avoid this challenge by limiting the usage of too many technical terms or jargon. Leverage clear and relatable analogies and focus on the customer benefits and real-world value rather than technical specifications. Fintech services can also offer informative resources and media training for spokespersons to ensure easily accessible and consistent messaging.

- Managing Reputation in a Digital-First Environment

A single breach of confidential data, no matter whether it is intentional or accidental, or a negative review, can severely damage the reputation of your fintech company.

Misinformation spreads like wildfire on social media platforms; it will be all over the Internet even before you know it. In an industry like fintech, which includes dealing with a vast amount of confidential consumer data, breaches are common.

To ensure effective fintech pr efforts, financial technology businesses must be proactive and prepared. Make sure to incorporate strict security measures and have a proper crisis communication plan in hand. Constantly track online conversations and respond quickly and professionally to customer issues as well as negative feedback.

To manage your online reputation successfully, you must focus on positive customer experiences through testimonials and case studies.

- Gaining Media Attention from Trusted Publications

Renowned financial journalists at publications such as “The Wall Street Journal” or “Bloomberg” often prefer stories about established and publicly traded companies, making it difficult for startups to get the attention.

Fintech businesses must stand out with engaging insights and stories. By offering unique data insights, highlighting innovative business models or sharing encouraging customer success stories, to can make your business stand out and get noticed by renowned media outlets.

Foster close relationships with experienced finance journalists, emphasising how your services or products will solve a customer’s problem.

- Aligning PR with Marketing and Business Goals

Oftentimes, PR efforts operate in silos, disconnected from the entire marketing campaigns or key business objectives, leading to wasted resources and inconsistent messaging.

In order to avoid this mistake, fintech businesses must ensure regular collaboration between marketing, PR, and executive leadership. Build shared key performance indicators (KPIs) and send consistent key messages across various channels.

Measuring PR Impact and ROI

Showcasing the visible return on investment (ROI) for public relations activities can be quite a task, as the results are often qualitative rather than quantitative (e.g., thought leadership, brand sentiment).

In order to deal with this challenge, fintech businesses must track both qualitative (e.g., media sentiment) and quantitative data (e.g., website traffic from earned media). Integrate these metric data with your business objectives to showcase your business’s value effectively.

FAQs

Fintech companies usually operate in a rapidly evolving space with heavy competition and strict regulations. Effective fintech public relations can help your company to establish trust among customers, enhance brand visibility, effectively manage a crisis, and position your founders as an authoritative source in the fintech industry.

Fintech companies can measure the success of their PR efforts by integrating quantitative and qualitative metrics. These may include media relations, social media engagement, and sentiment analysis. They can also determine the success through partnership opportunities, lead generation, and investor interests.

Yes, public relations is a very important investment for fintech companies. In an industry where trust and credibility matter the most, PR serves as a tactical blessing to stand out in the highly competitive market, manage a brand’s reputation, and attract more investors.

Conclusion

Fintech PR is crucial for establishing trust and credibility, which are crucial in finance. If you are someone who is looking to build trust among potential clients and enhance your brand awareness, then you must start by incorporating the public relations strategies mentioned above. However, managing public relations efforts and building relations with renowned industry media outlets while managing a fintech business is almost impossible. In this case, we suggest that you partner with an expert PR agency that offers personalized PR solutions.